japan corporate tax rate 2018

Since then the rate peaked at 528 in. Where a corporation hires new employees which has been increased to JPY 400000 per person for fiscal periods beginning on or after 1 April 2013 until.

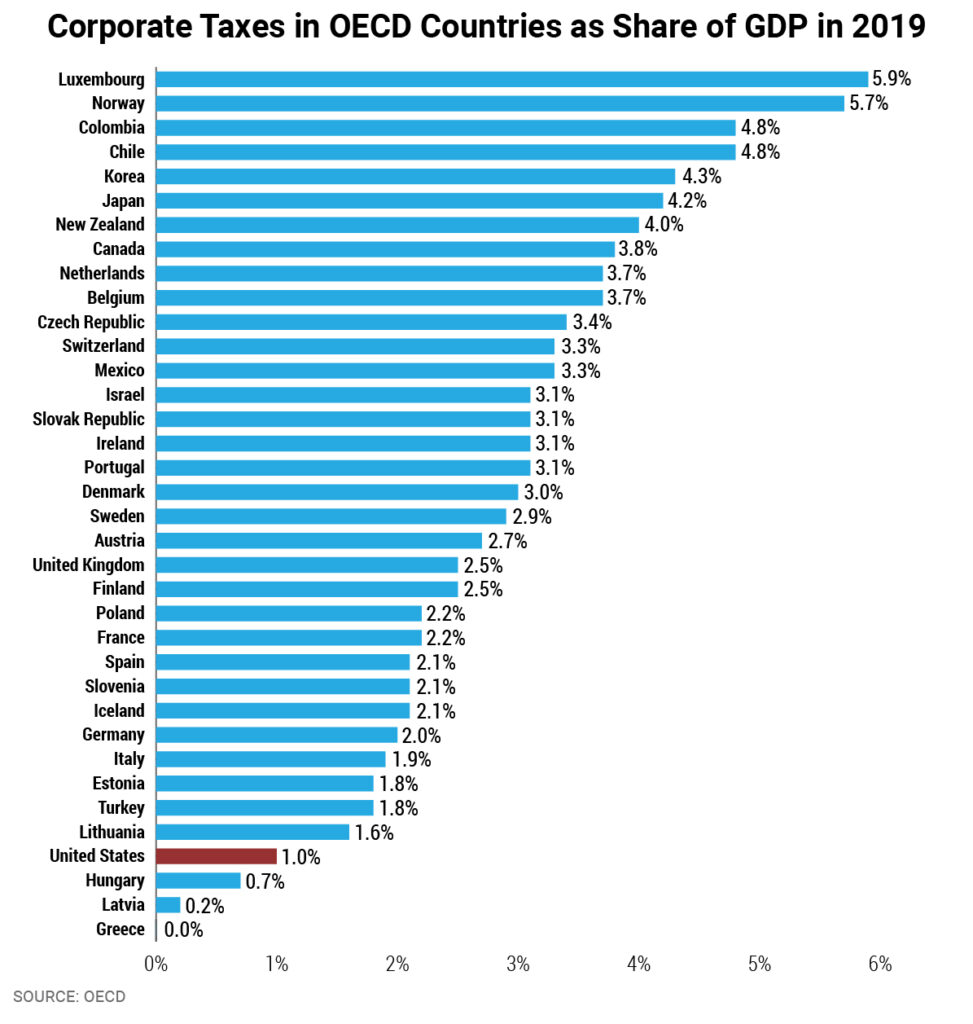

Corporate Tax Reform In The Wake Of The Pandemic Itep

Details of Tax Revenue Japan.

. Use our interactive Tax rates tool to compare tax rates by country or region. The consumption tax rate to 10 which includes a 22 local. Taxable income 4 mln 8 mln 4 mln 8 mln.

Year Taxable Income Brackets Rates Notes. Details of Tax Revenue Korea. Product Market Regulation 2018.

Tax notification must also be submitted when a foreign corporation generates income subject to corporate tax in Japan without establishing a branch office ie where 2 of. Regulation in Network and Service Sectors 2018. Historical Federal Corporate Income Tax Rates and Brackets 1909 to 2020.

Income from sources in Japan during each business year. Government at a Glance. Under the 2020 Tax Reform Act a corporate taxpayer will be allowed to apply one month extension for the consumption tax returns by filing an advance application from tax.

Application for the Mutual Agreement Procedure PDF167KB Instructions for Completing Application for the Mutual Agreement Procedure. KPMGs corporate tax table provides a view of corporate tax rates around the world. Statutory Corporate Income Tax Rate in Japan as of April 2014 1.

A tax credit for job creation ie. 2018-2020 All taxable income. The federal corporate income tax was fist implemented in 1909 when the uniform rate was 1 for all business income above 5000.

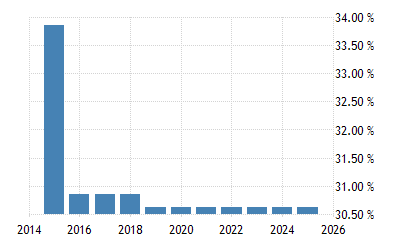

Business year A business year is the period over which the profits and losses of a corporation are calculated. The government and ruling bloc plan to slash the effective corporate tax rate to 2974 percent in the fiscal year starting April 2018 from the current 3211 percent sources said. The effective corporate tax rate is the percentage of income from a marginal investmentthat is an investment that pays just enough to make the investment worthwhilethat must be paid in.

Principal business entities These are the joint stock company limited liability company partnership and branch of a foreign corporation. Information about International Tourist Tax. The business year is.

Overview of the Consumption Tax System in Japan - May 2018 Yasutaka Nishikori Nishimura Asahi 1 Historical Background.

Doing Business In The United States Federal Tax Issues Pwc

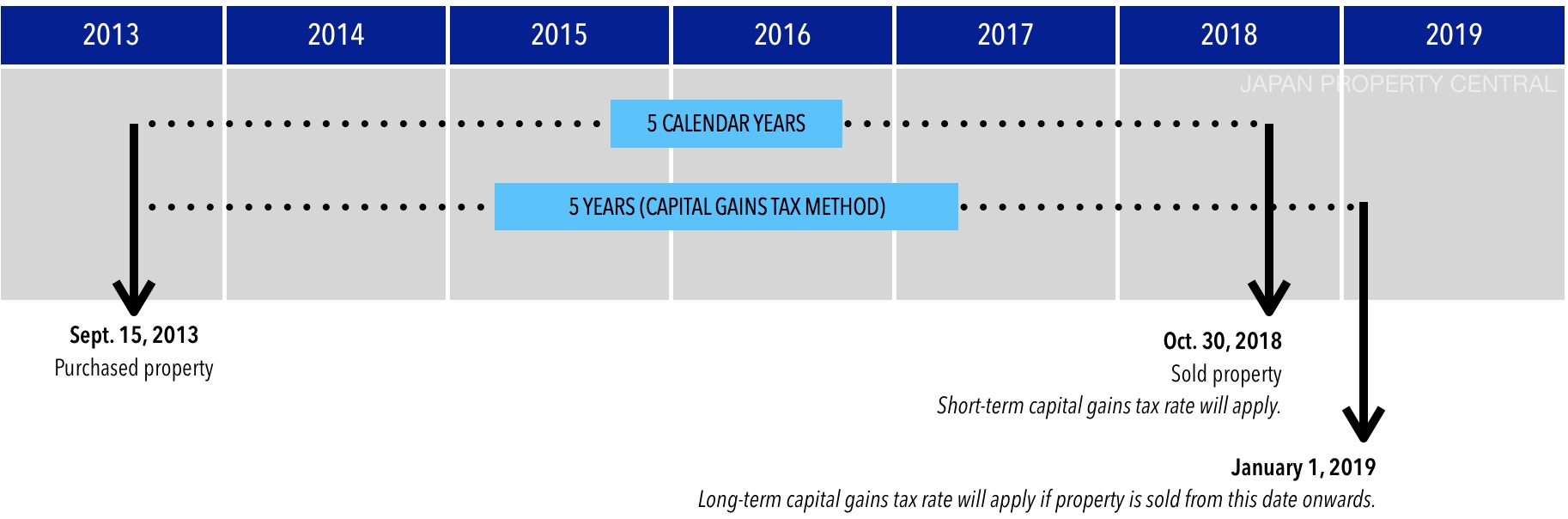

Capital Gains Tax Japan Property Central

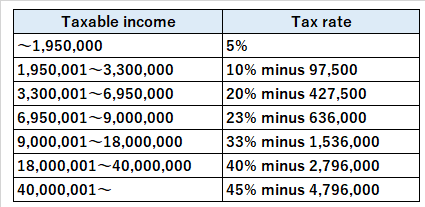

Individual Income Tax Return Filing In Japan For Foreigners Latest 2021 2022 Shimada Associates

Real Estate Related Taxes And Fees In Japan

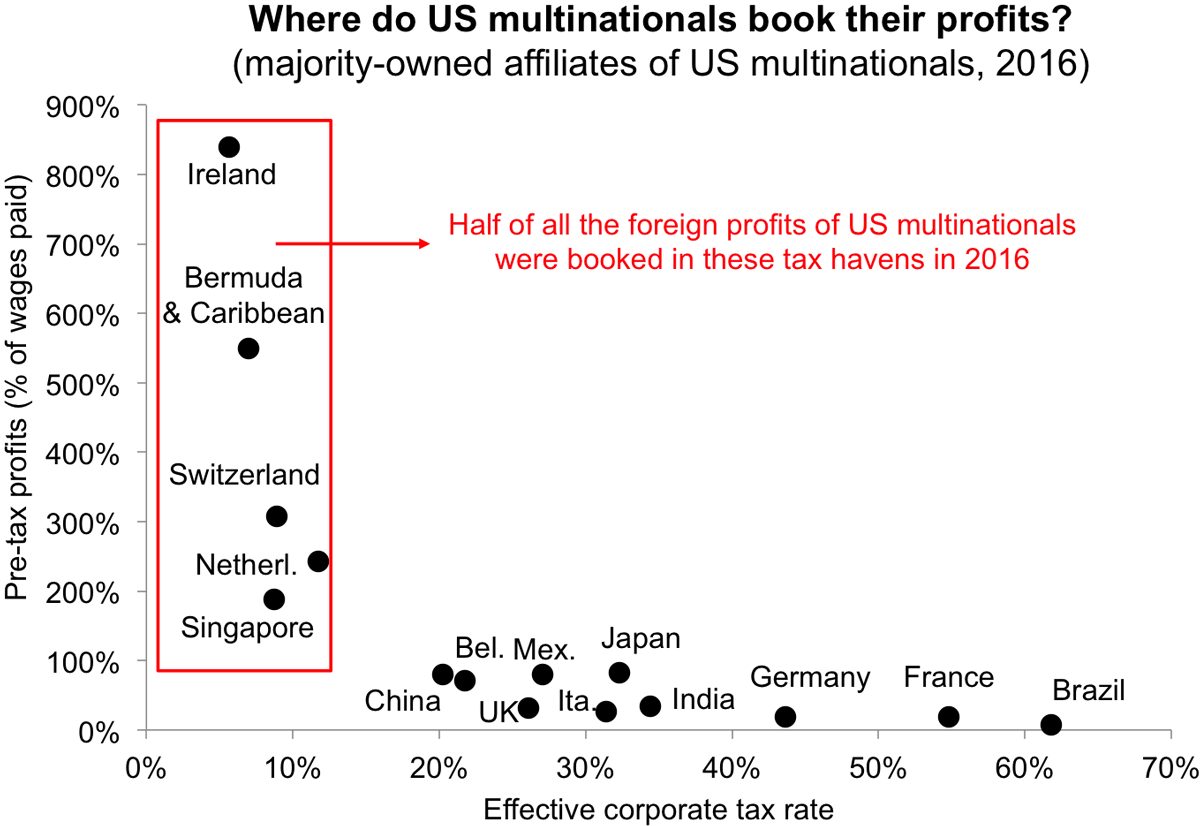

Taxing Multinational Corporations In The 21st Century Economics For Inclusive Prosperity

Japan National Tax Revenue Statista

Real Estate Related Taxes And Fees In Japan

Corporate Tax Reform In The Wake Of The Pandemic Itep

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

International Corporate Tax Reform Dgap

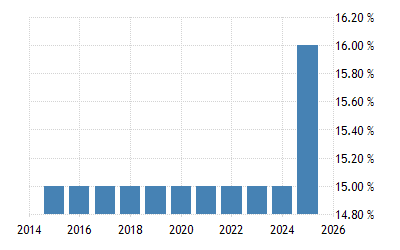

Lithuania Corporate Tax Rate 2022 Data 2023 Forecast 2006 2021 Historical

Korea Tax Income Taxes In Korea Tax Foundation

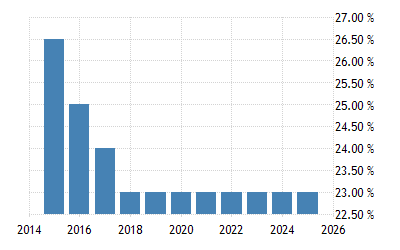

Israel Corporate Tax Rate 2022 Data 2023 Forecast 2000 2021 Historical Chart

North Carolina Ranks Third Nationwide In Competitive Corporate Income Taxes Economic Development Partnership Of North Carolina

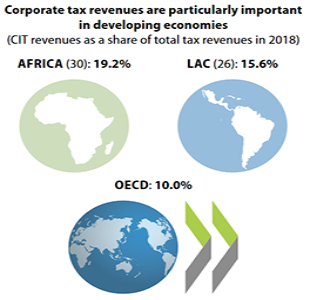

Corporate Tax Remains A Key Revenue Source Despite Falling Rates Worldwide Oecd

Corporation Tax Europe 2021 Statista

日本 企业所得税税率 1993 2021 数据 2022 2024 预测

Taxing Corporations Might Be Good Politics But It S Still Bad Policy Cato Institute